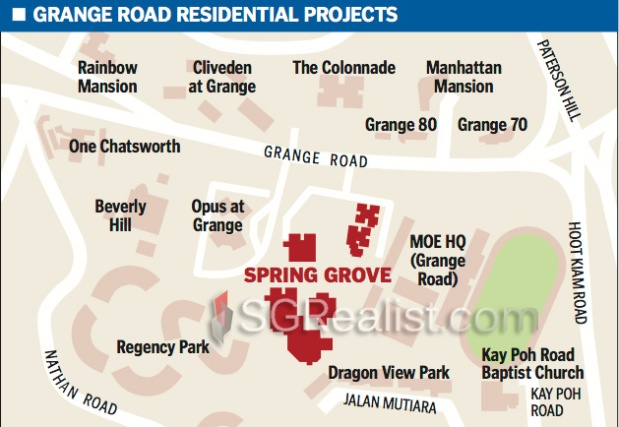

News that the Spring Grove condominium in Grange Road could undergo a $1.045 billion collective sale has put the spotlight on other residential blocks in the same street.

The high-end sector has been down in the dumps for months, so the prospect of a big payday for Spring Grove owners has raised eyebrows among property experts.

Grange Road, like many other prime city neighbourhoods, has come under the pressures of the additional buyer’s stamp duty and the risk of more cooling measures.

Some developers have found it challenging to move new units along the stretch.

The Twin Peaks project has released 70 of its 462 units, with sales of 68 as of February at a median price of $3,157 per sq ft.

The project, which is due for completion in 2015, comprises two 35-storey towers of one-, two- and three-bedroom apartments.

Some completed projects still have apartments for sale.

Only 18 units at The Lumos have found owners. The project started sales in 2007 and all 53 units are available for purchase.

The neighbouring Cliveden at Grange, which was finished in 2011, has sold about 80 per cent of its 110 units since its 2007 launch.

The surplus of new homes will increase with the launch of at least three new projects in the area – iLiv@Grange, Ferra and Opus at Grange.

Developers have yet to announce launch dates but it is estimated that the new projects could add just over 300 new homes to the neighbourhood.

Resale activity in Grange Road has also slowed, with decreases in both prices and transaction numbers.

Mr Ong Kah Seng, director of R’ST Research, said there were around 10 to 20 resales in the area per quarter in 2010 and 2011 but that fell to fewer than 10 transactions per quarter last year.

“In 2012, (resale) prices averaged a fall of less than 5 per cent. In 2011, prices were seen as generally stable, dipping by up to 3 per cent,” said Mr Ong.

Knight Frank data shows that last year, only 21 resale transactions were made for homes in the Grange Road neighbourhood. Prices averaged $2,094 psf.

Ms Alice Tan, senior manager of research and consultancy at Knight Frank, said rents for Grange Road properties of less than 3,000 sq ft averaged $7.70 psf per month for the first two months of this year.

That is a 9.3 per cent decline from last year’s monthly average of $8.49 psf per month.

Mr Ong pointed out that Grange Road apartments have seen sustained interest from tenants even as high-end leasing activity has slowed down significantly recently.

“In 2012, rents in the area have decreased by 5 per cent on average. But the more affordable, older apartments like Spring Grove have continued to see active leasing interest and stable rents throughout 2012.”

Analysts still predict it is not going to be all doom and gloom for the area in the near future. Ms Tan said: “Investors and home buyers are constantly on the lookout for value buys in prime districts. Therefore, private homes in this locality still hold potential for improvement in demand.”

Mr Ong agreed: “There are possibilities for a gradual recovery in prices and rents in the area underpinned by its exclusive location and global economic improvements in Western countries.”

(Source: The Straits Times)

You must be logged in to post a comment.